The Ministry of Commerce and Industry has recently shared a list of certain products with the Ministry of Finance to address Inverted Duty Structure (IDS) issues.

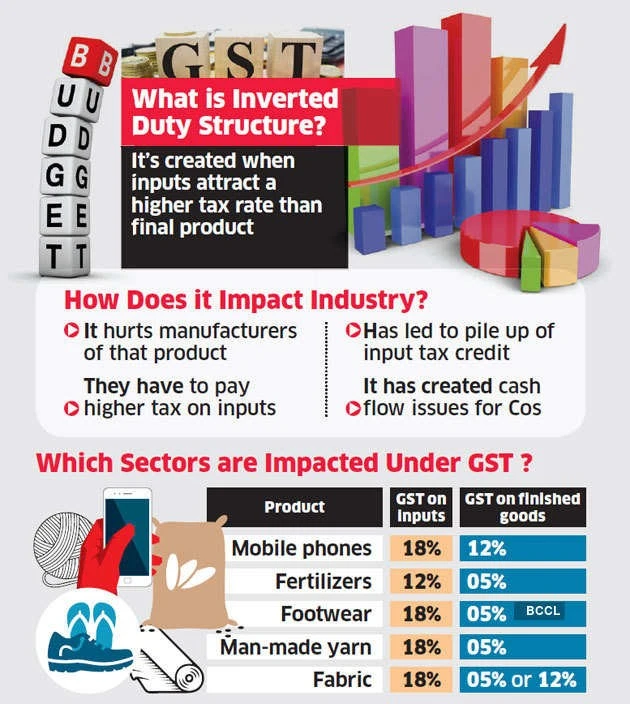

About Inverted Duty Structure (IDS):

- IDS refers to a situation where the import tariff on inputs is higher than the tax levied on the final output.

- In other words, the GST rate paid on purchases is more than the GST rate payable on sales.

Other key facts:

- ITC: The Goods and Services Tax (GST) paid by a taxable person on any purchase of goods and/or services that are used or will be used for business.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |