The Securities and Exchange Board of India (SEBI) has recently unveiled new measures to address and prevent front running, insider trading, and misuse of sensitive information in asset management companies (AMCs).

About Front Running:

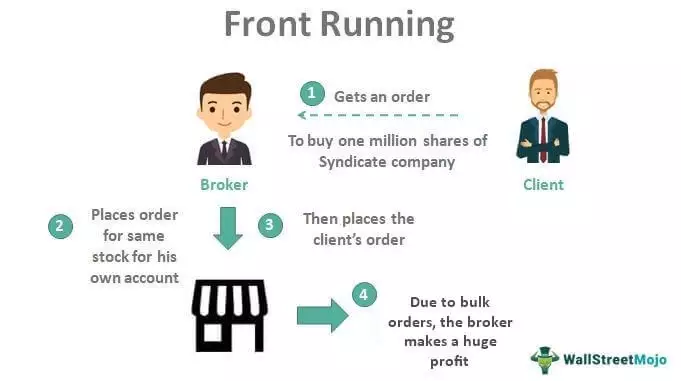

- Front running involves the illegal use of non-public information by brokers to trade securities before executing substantial orders from investors.

- It undermines market confidence and creates an uneven playing field.

- Front running is prohibited under Indian law.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Question:

What is front running in the context of securities trading?

Front running refers to brokers using non-public information to trade securities before executing large orders from investors. It is illegal and creates unfair advantages in the market.

Why is front running considered detrimental to market integrity?

Front running undermines market confidence and creates an uneven playing field for investors. It can lead to market manipulation and unfair advantages for certain individuals or entities.

How does the Securities and Exchange Board of India (SEBI) address front running?

SEBI has introduced new measures to prevent front running, insider trading, and misuse of sensitive information in asset management companies (AMCs). These measures aim to promote market integrity and protect investors.

What are the consequences of engaging in front running activities?

Engaging in front running activities can lead to legal repercussions, including fines, penalties, and potential criminal charges. It can also result in damage to one’s reputation and the loss of trust from investors and regulatory authorities.