Basel Norms are international banking regulations established by the Basel Committee on Banking Supervision (BCBS) to ensure financial institutions have adequate capital to fulfil their obligations and absorb unexpected losses. The Basel Norms consist of three sets of guidelines, known as Basel I, II, and III. Each accord focuses on specific aspects of banking risk management, with Basel III responding to weaknesses exposed by the 2008 financial crisis. In this article, you will know about meaning and definition of Basel Norms, what is Basel committee on Banking Supervision, key provisions of Basel -I, Basel -II and Basel -III regulations, all of which are important for GS Paper-3 Economy subject of UPSC IAS Exam. To explore more interesting UPSC Economy topics like Basel Norms, check out other articles and IAS Notes of IASToppers.

Table of Content

- What are Basel Norms?

- Basel committee on Banking Supervision

- Basel Regulations

- Basel – I

- Basel – II

- Basel – III

- Key Concepts

- What is Tier I and Tier 2 capital?

- What is the Need for capital to cover up assets?

- Conclusion

- FAQs on Basel Norms

What are Basel Norms?

- Basel Norms refer to a set of regulations established by the Basel Committee on Banking Supervision (BCBS) to govern international banking.

- The primary objective of these norms is to ensure global coordination of banking regulations and to guarantee that financial institutions possess sufficient capital to meet their obligations and handle unforeseen losses.

Basel committee on Banking Supervision

- The Basel Committee on Banking Supervision (BCBS) is a committee within the Bank for International Settlements.

- Established in 1974 by the Group of Ten countries’ Central Bank governors, its main focus is on discussing banking supervisory matters.

- The BCBS’s secretariat is located at the Bank of International Settlements (BIS) headquarters in Basel, Switzerland, giving rise to the name “Basel Norms.”

- It has four subcommittees/groups:

- Accord Implementation Group,

- Policy Development Group,

- Accounting Task Force,

- International Liaison Group

- It meets four times a year.

- It consists of 45 members from 28 jurisdictions, including India, comprising central banks and regulatory authorities.

- While the committee provides guidance and best practices to its members, it holds no legal supervisory authority over any country’s banking system.

Basel Regulations

Presently the Basel Committee has issued 3 guidelines to realize its objective which are Basel I, II and III.

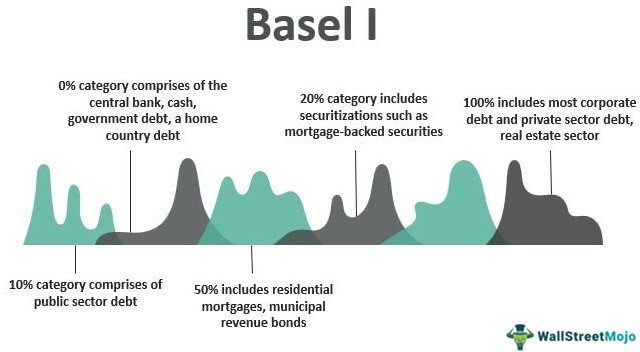

What is Basel – I norm?

- Introduced in 1988, Basel I implemented a capital measurement system known as Basel Capital Accord (Basel 1 norms).

- Its primary focus revolved around credit risk management.

- It established definitions for capital and risk weights applicable to banks.

- Capital classification involved two categories: Tier 1 and Tier 2 capital.

- The minimum capital requirement was fixed at 8% of risk weighted assets (RWA).

- India adopted Basel-I Norms in 1999.

What is Basel – II norm?

Alt-text: Basel II Norms

- Published in June 2004, Basel II (Basel 2 norms) is considered an improved version of the Basel I accord.

- Basel II was based on 3 fundamental pillars:

- Capital Adequacy Requirements: Banks were mandated to maintain a minimum capital adequacy requirement of 8% of risk assets.

- Supervisory Review: Banks were required to employ enhanced risk management techniques to monitor and manage credit, market, and operational risks.

- Market Discipline: Banks were obligated to disclose their Capital Adequacy Ratio (CAR), risk exposure, and other relevant information to the central bank.

- Reserve Bank of India implemented the Basel II norms in India from 31st March 2009.

What is Basel – III norm?

- Basel – III guidelines werereleased in 2010 as a response to the 2008 financial crisis.

- Basel III was necessary due to under-capitalization, excessive leverage, and a heavy reliance on short-term funding seen in developed economies.

- Basel III norms aim at making most banking activities such as their trading book activities more capital-intensive.

- It specifically requires higher capital amounts and quality for derivatives, Over the Counter (OTC) transactions, repos, and stock lending transactions.

- It comprises three capital components: Tier 1, Additional Tier 1, and Tier 2.

- It focused on 4 vital banking parameters:

- Capital:

- Banks must maintain a capital adequacy ratio of 12.9%.

- The minimum Tier 1 capital ratio and minimum Tier 2 capital ratio should be 10.5% and 2% of risk-weighted assets, respectively.

- Banks have to maintain a capital conservation buffer of 2.5%.

- Leverage:

- Banks must maintain a leverage ratio of at least 3%.

- The leverage ratio is calculated by dividing a bank’s Tier 1 capital by its average total consolidated assets.

- Funding and Liquidity:

- Basel III introduces two liquidity ratios:

- Liquidity coverage ratio (LCR): It mandates banks to hold a buffer of high-quality liquid assets to handle cash outflows during short-term stress scenarios.

- Net Stable Funds Rate (NSFR): It requires banks to maintain a stable funding profile in relation to their off-balance-sheet assets and activities.

- The minimum LCR and NSFR requirement is 100 %.

- LCR measures short-term (30 days) resilience while NSFR measures medium-term (1 year) resilience.

- Basel III introduces two liquidity ratios:

- Basel III, released in 2010, was implemented from 1st January 2023 in other countries. However, the deadline for Basel 3 norms implementation in India was set at March 2019.

- Reserve Bank of India (RBI) is monitoring the overall implementation of BASEL III Norms in India.

Comparison of Capital requirements under Basel III norms in India for Indian banks and the rest of the world

| Division | Capital Norm | Basel III International | India |

| A (B+D) | Minimum Total Capital | 8 | 9 |

| B | Minimum Tier I Capital | 6 | 7 |

| C | of Which: Minimum Common Equity Tier I | 4.5 | 5.5 |

| D | Maximum Tier 2 capital (in total capital) | 2 | 2 |

| E | Capital Conservation Buffer (CCB) | 2.5 | 2.5 |

| F (C + E) | Minimum Total Capital Tier I | 7 | 8 |

| G = A + E | Minimum Total Capital + CCB | 10.5 | 11.5 |

| H | Leverage Ratio | 3 | 4 |

What is Basel IV norms?

- 2 new standards: Fundamental Review of the Trading Book (FRTB) and the Basel 3.1: Finalising post-crisis reforms, are sometimes referred to as Basel IV (Basel 4 norms).

- Basel 4 incorporated new criteria for managing credit and operational risks along with a credit valuation adjustment.

- It established a minimum limit on calculated risk (output floor), redefined the concept of the leverage ratio, and extended its application to globally significant banks.

Key Concepts

Capital Buffer

The concept of capital buffer was introduced by the Basel Committee on Banking Supervision and consists of two structures: the Capital Conservation Buffer (CCB) and the Countercyclical Capital Buffer (CCCB).

Capital Conservation Buffer (CCB)

- The Capital Conservation Buffer (CCB) is designed to ensure that banks build up additional capital during normal times, which can be used to cover losses during stressful periods.

- CCB must be in the form of equity capital.

- CCB is in addition to the 4.5% minimum requirement for Common Equity Tier 1 capital.

- Reserve Bank of India (RBI) has chosen 2.5% of capital buffer as percentage of risk-weighted assets.

Countercyclical Capital Buffer (CCCB)

- The Countercyclical Capital Buffer (CCCB) serves as an extension to the conservation buffer.

- As per RBI, CCCB has two objectives:

- To build up a capital buffer during good times which may be used to provide as a credit in difficult times

- To prevent excessive lending during periods of excess credit growth.

- The CCCB can range between 0% to 2.5% of risk-weighted assets

- CCCB can be maintained in the Common Equity Tier 1 capital or other fully loss absorbing capital such as common equity, subordinated debt etc.

Leverage ratio (LR)

- The leverage ratio under the Basel III is defined as the capital measure divided by their exposure measure.

- The exposure measure includes on-balance sheet exposures, derivative exposures, securities financing transaction (SFT) exposures, and off-balance sheet (OBS) items.

- It measures bank’s core capital as a ratio of its total assets.

- The leverage ratio measures a bank’s core capital as a ratio of its total assets.

- It is basically a ratio to measure a bank’s financial health.

- It shows how much quality funds the bank has to overcome asset-related problem in future.

- A higher leverage ratio indicates a greater ability to withstand financial stress.

- In India, the minimum leverage ratio is 4% for Domestic Systemically Important Banks (DSIBs) and 3.5% for other banks.

Liquidity Coverage Ratio (LCR)

- The Liquidity Coverage Ratio (LCR) refers to the proportion of highly liquid assets held by financial institutions to meet short-term obligations during times of financial stress.

- It ensures that institutions can survive acute financial crises by having enough high-quality assets that can be easily converted into cash.

Provisioning Coverage Ratio (PCR)

- The Provisioning Coverage Ratio (PCR) is the ratio of provisioning to gross non-performing assets.

- It represents the percentage of bad assets (loan losses) that a bank sets aside from its own funds.

- The PCR varies for different categories of non-performing assets (NPA) such as doubtful assets and sub-standard assets.

What is Tier I and Tier 2 capital?

- Capital is classified in terms of its degree of contribution from its owners.

Tier 1 capital

- Tier 1 capital consists of equity capital provided by shareholders.

- It represents high-quality capital that shows the financial strength of a bank from a regulatory perspective.

- This includes basic equity capital, disclosed reserves, and non-redeemable non-cumulative preferred stocks.

- This capital can absorb losses without a bank being required to cease trading.

Tier 2 capital

- Tier 2 capital includes reserves, debts, undisclosed reserves, revaluation reserves, loan-loss reserves, hybrid capital instruments, and subordinated debt.

- It serves as supplementary capital and provides a lesser degree of protection to depositors in the event of a winding-up.

What is the Need for capital to cover up assets?

- One of the key lessons learned from the 2007 financial crisis is the importance of having sufficient capital to safeguard financial institutions.

- Financial institutions, particularly banks, encounter various risks, including market risk and credit risk.

- The level of capital required to address these risks should be proportional to their severity.

- The capital needed by a bank is determined by two factors: i) the total value of its assets (such as loans) and ii) the risk associated with those assets.

- To assess the appropriate capital requirement, it is important to evaluate the riskiness of the bank’s assets by assigning risk weights to loans.

- Such evaluation can be done through the Capital to Risk (Weighted) Assets Ratio (CRAR).

Conclusion

The Basel Norms in banking – Basel I, II, and III – represent significant milestones in global banking regulation, ensuring financial stability and resilience through comprehensive risk management. These norms ensure that financial institutions maintain adequate capital reserves to meet their obligations and absorb unforeseen losses. The Basel Norms have evolved over time, responding to the changing dynamics of the global financial environment, the most notable being the 2008 financial crisis. India’s adoption of these norms and subsequent modifications reflects the country’s commitment to international banking standards

Ref: Source-1

| Other Articles in Economy | |

| G20 (Group of 20) | Economic Impact of British Rule in India |

| Kuznets Curve | Small Finance Banks (SFB) |

| Payment Banks | Laffer Curve |

FAQs (Frequently Asked Questions)

What are the Basel Norms and why were they formed?

Basel Norms are a set of banking regulations established by the Basel Committee on Banking Supervision (BCBS) to ensure international coordination of banking regulations and to guarantee financial institutions have adequate capital to meet their obligations and handle unexpected losses. These norms are essential for maintaining global financial stability and preventing banking crises

What is the difference between Basel I, II, and III norms?

Basel I focused on credit risk management and established the minimum capital requirement at 8% of risk-weighted assets. Basel II introduced three pillars: Capital Adequacy Requirements, Supervisory Review, and Market Discipline. Basel III, developed in response to the 2008 financial crisis, requires higher capital amounts and quality for specific banking activities, and focuses on capital, leverage, and funding and liquidity.

What is the history of Basel norms?

Basel norms, initially introduced in 1988 as Basel I, laid the foundation for credit risk management. This evolved into Basel II in 2004, introducing three pillars focused on capital adequacy, supervisory review, and market discipline. Post the 2008 financial crisis, Basel III emerged in 2010, enhancing capital requirements and introducing liquidity ratios. The most recent, Basel IV, refines the existing norms and addresses credit and operational risks more comprehensively.

What is the difference between Tier 1 and Tier 2 capital in the Basel Norms?

Tier 1 capital consists of high-quality capital, including basic equity capital, disclosed reserves, etc and can absorb losses without the bank having to cease trading. Tier 2 capital includes reserves, debts, undisclosed reserves etc. and provides a lesser degree of protection to depositors in the event of a winding-up.