The Securities and Exchange Board of India (SEBI) has recently permitted mutual funds to actively participate in the Credit Default Swaps (CDS) market.

- This initiative aims to enhance liquidity in the corporate bond market and provide mutual funds with additional tools to manage credit risk.

Key Changes:

- Expanded Flexibility: Mutual funds can now buy and sell CDS, significantly broadening their investment strategies.

- Investment Product: CDS serves as an additional investment option for mutual funds, helping them manage credit risk more effectively.

Previous Restrictions:

- Prior to this change, mutual funds were limited to using CDS solely for protection against the credit risk of corporate bonds they held.

- Transactions were restricted to Fixed Maturity Plan (FMP) schemes with a duration of over one year.

About the Credit Default Swaps (CDS):

- CDS are financial instruments that function as insurance against the risk of default by a borrower on debt obligations.

Functionality:

- CDS act like insurance contracts, providing protection to investors in case the bond issuer defaults on payments.

- The protection is maintained through regular premium payments, akin to traditional insurance contracts in the bond market.

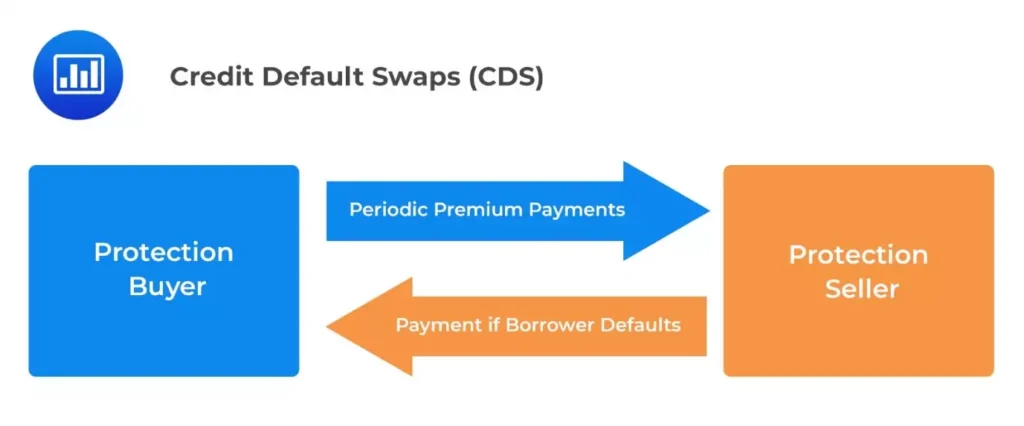

Mechanism:

- A protection buyer enters a contract with a protection seller.

- The buyer pays a regular premium to the seller.

- If a default event occurs, the seller is obligated to compensate the buyer with a specified amount.

Example:

- If an investor owns a corporate bond issued by a company and fears default, they can purchase a CDS on that bond.

- In case of default, the CDS seller will compensate the investor for their losses.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Question:

What recent change has SEBI introduced regarding mutual funds and Credit Default Swaps?

SEBI now allows mutual funds to buy and sell CDS, expanding their investment strategies.

How do Credit Default Swaps work?

CDS function like insurance contracts, where a buyer pays premiums to a seller, and in case of default, the seller compensates the buyer.

What was the previous restriction on mutual funds using CDS?

Mutual funds were restricted to using CDS only for protection on corporate bonds in Fixed Maturity Plans with durations over one year.

What is the primary benefit of allowing mutual funds to participate in the CDS market?

It enhances liquidity in the corporate bond market and provides mutual funds with more tools to manage credit risk.

How does CDS help manage credit risk?

By purchasing CDS, investors can protect themselves from

potential losses if a bond issuer defaults.