Securities and Exchanges Board of India has released a framework according to which privately placed Infrastructure Investment Trusts (InvITs) can issue subordinate units.

About Infrastructure Investment Trusts (InvITs):

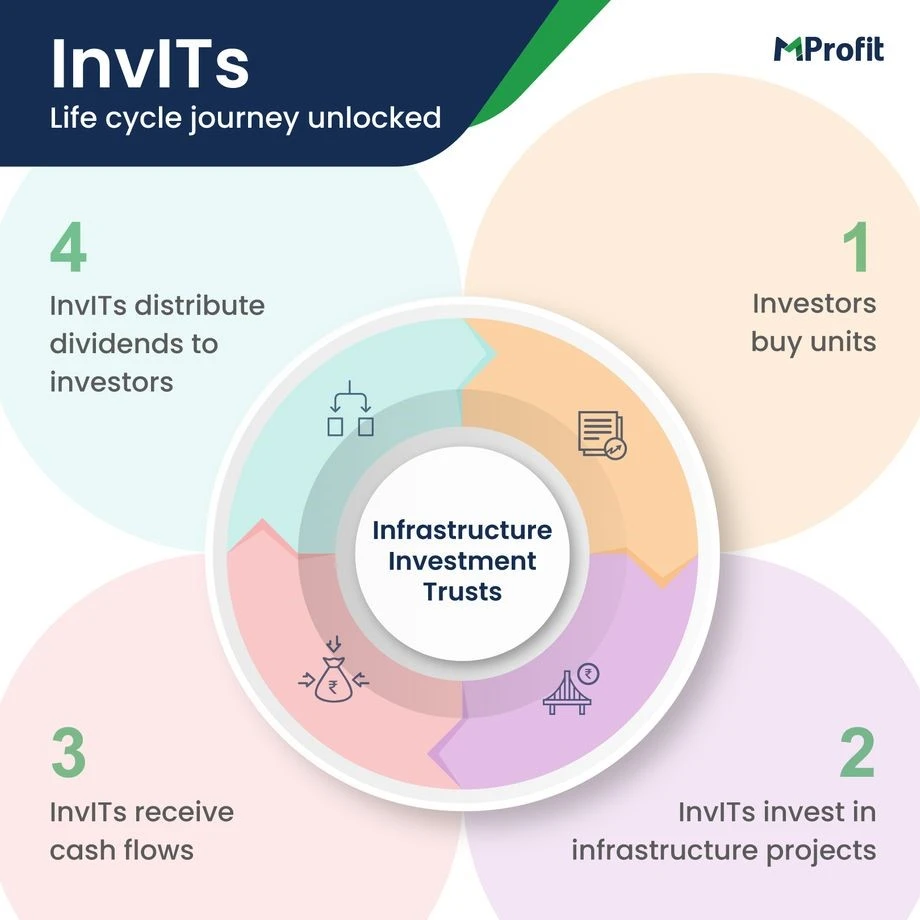

- InvITs are a type of investment vehicle similar to a mutual fund that allows investors to invest in infrastructure projects like toll roads, power lines, and pipelines.

- Sponsors (infra companies) set up InvITs through SEBI and are recognized as borrowers under the SARFAESI Act 2002.

- Parties to an InvIT include its trustee, sponsor, investment manager, and project manager.

- InvITs earn income through tolls, rents, interest, or dividends from their investments, which is distributed to investors as their taxable earnings.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Questions (FAQs):

What is an Infrastructure Investment Trust (InvIT)?

An InvIT is an investment vehicle that functions similarly to a mutual fund, allowing investors to pool funds and invest in infrastructure projects such as toll roads, power lines, and pipelines.

How are InvITs regulated in India?

InvITs are set up and regulated by the Securities and Exchange Board of India (SEBI), ensuring they comply with the necessary regulatory frameworks.

What is the significance of the SARFAESI Act 2002 in relation to InvITs?

Under the SARFAESI Act 2002, sponsors of InvITs are recognized as borrowers, which has implications for how they can raise and manage funds within the framework of Indian financial regulations.