Infrastructure Investment Trusts (InvITs), similar to mutual funds, offer a means of pooling investor funds and directing them towards completed, revenue-generating infrastructure projects. They play an important role in enhancing India’s infrastructure sector by attracting investors. InvITs offer benefits such as diverse assets, steady earnings, and potential for debt reduction for promoters. However, they also come with risks such as uncertainty in revenue streams, regulatory and inflation risks, and delayed returns due to long project timelines. In this article, you will know about meaning and definition of Infrastructure Investment Trust (InvITs). To explore more interesting UPSC Economy topics like Infrastructure Investment Trust, check out other articles and IAS Notes of IASToppers.

What is Infrastructure Investment Trust (InvITs)?

- An Infrastructure Investment Trust (InvITs) is institution similar to mutual funds.

- It pools investment from various investors and invest them into completed and revenue generating infrastructure projects, thereby creating returns for the investor.

- InvITs can be treated as the modified version of Real Estate Investment Trusts (REITs). designed to suit the specific circumstances of the infrastructure sector.

- InvITs’ primary goal is to boost India’s infrastructure sector by attracting more investors, adaptable to various scenarios.

- InvITs are regulated by the SEBI (Infrastructure Investment Trusts) Regulations, 2014.

- InvITs can be established as a trust and registered with SEBI.

- InvITs are recognized as borrowers under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act).

Similarities between InvIT and Mutual Fund:

- Have a 3-tiered management structure (sponsor, trustee, and manager)

- Allow multiple investors to pool their investments

- Assets are managed by a designated manager

What is the need for InvITs?

Infrastructure projects includes huge upfront costs. Recouping this investment typically extends over several years, causing firms to grapple with substantial debt and limited capital for new projects. Establishing an Infrastructure Investment Trust (InvIT) can help these companies maintain sustainable operations:

- Selling InvIT units allows infrastructure companies to collect funds from diverse investors without amassing debt. This capital can help in settling existing liabilities, acquiring new assets, or pushing forward pending projects, thereby fuelling business growth.

- Unlike corporations, trusts enjoy several tax privileges. Thus, an InvIT could grant an infrastructure firm access to tax benefits, boosting its after-tax income. This extra revenue can also propel the firm’s growth.

Formation of InvIT

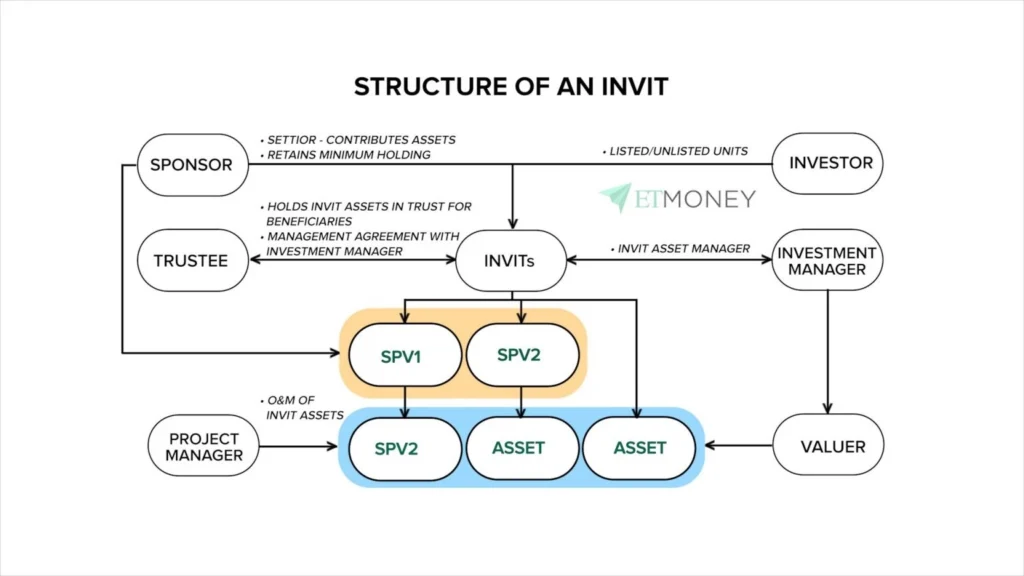

An InvIT consists of 4 entities:

- Trustee – Responsibility of inspecting the performance of an InvIT.

- These individuals need SEBI registration as debenture trustees and should commit at least 80% of their investment to stable revenue-generating infrastructure assets.

- Sponsor(s) – Promoters of the company that set up the InvIT

- Commonly a corporate entity, LLP, promoter, or a company possessing a net worth of Rs. 100 crore or above, serves as a sponsor.

- They have to retain a minimum of 15% of total InvITs for a least 3 years.

- Investment Manager – Supervising the assets and investments of the InvIT

- Project Manager – Execution of the project

How InvIT is formed?

- An Infrastructure Development Firm initiates InvIT process by assuming Sponsor role and assigning a Trustee.

- Sponsor gives away all control over InvIT assets once the Trustee takes charge.

- Trustee: Manages assets set to be incorporated into InvIT.

- Trust can directly control assets or use a Special Purpose Vehicle (SPV) for indirect management.

- Trustee appoints two managers: an investment manager and a project manager.

- Investment manager: ensures profitable returns on current investments and leads in making decisions to increase assets.

- Project manager: oversees infrastructure assets and timely project completion.

- Post registration with SEBI, InvIT can list on stock exchanges to raise funds publicly or privately sell units to limited investors.

Types of InvITs

As per existing SEBI guidelines, InvITs can be classified into five main categories based on their assets:

- Energy, such as power generation and distribution.

- Transport & Logistics, such as highways and toll roads operation.

- Communications, such as optical fibre networks and telecom towers.

- Social and Commercial Infrastructure, such as parks.

- Water and Sanitation, such as irrigation networks.

Also, InvITs can be categorized into two types based on their funding source:

- Private InvITs: These units are privately owned by a restricted group of individuals or institutions. These InvITs are not listed on the stock exchange, and their units cannot be traded there.

- Publicly Listed InvITs: These InvITs have listed themselves on the stock exchange. Their units can be bought and sold by both retail and institutional investors on the stock exchange. owever, SEBI regulations do not mandate the listing of InvITs on stock exchanges.

Advantages of InvITs

- Access to Diverse Assets: InvITs enable investors to add a new asset class (infrastructure projects) to their portfolio. This is different from equity investments in infrastructure companies or mutual funds which may not provide the same level of diversification.

- Steady Earnings: InvITs provides mandatory payout of a minimum 90% of the income as dividends or interest bi-annually. This could provide investors with a consistent revenue stream.

- Expertly Handled Projects: Investing in InvITs gives investors a partial stake in an infrastructure asset, with the assurance that these projects are managed by proficient managers. This reduces any complications for investors.

- Profit Opportunities: InvIT units can be sold on the stock market, similar to shares. If the InvIT performs well, unit prices could rise, providing investors with the opportunity to profit.

- Reduction of debt for Promoters: Promoters investing in InvITs can significantly reduce their debt load via asset liquidation. The obtained proceeds can be recycled into other projects within their portfolio.

Disadvantages of InvITs

- Uncertain Revenue Stream: Returns from infrastructure projects such as highways are reliant on tariffs and usage. Changes in these variables due to factors like governmental intervention or reduced usage can adversely affect the income.

- Tax on Earnings: Income from dividends and interest from InvITs are fully taxable as per the investor’s tax slab.

- Limited Options: Number of publicly listed InvITs in India is only two, limiting the choices available for retail investors.

- Poor Liquidity: While InvIT units can be traded on the stock market, the level of market participation is low. This can pose challenges when trying to sell units at a desirable price during emergencies.

- Regulatory Risks: Any minor alterations in the regulatory infrastructure, such as changes in taxation or sector-specific policies, could significantly affect InvITs.

- Inflation Risk: High inflation rates can considerably influence the performance of infrastructure investment trusts. For example, inflation can inflate the operational costs of the sector. Moreover, if toll rates rise, the potential for significant returns diminishes.

- Asset Risk: Investments in infrastructure typically have a lengthy gestation period, causing a delayed return generation. This delay can negatively affect cash flow and impair profit estimates.

Conclusion

Infrastructure Investment Trusts (InvITs) play a pivotal role in uplifting India’s infrastructure by drawing in diverse investors. They provide an attractive avenue for steady income, debt reduction for promoters, and access to a range of infrastructure projects. For a more vibrant and robust InvITs market, the Indian government could consider further regulatory improvements, enhance liquidity, and create a more conducive environment for a greater number of InvITs to be publicly listed, thereby offering more choices to investors.

Ref: Source-1

| Other Articles in Economy | |

| Participatory Notes | Privatization of Government Sector |

| Universal Basic Income | E-Commerce |

| Goods and Services Tax Council | Marginal Cost of Funds based Lending Rate (MCLR) |

FAQs (Frequently Asked Questions)

What is the key difference between InvITs and REITs in India?

The main difference between InvITs and REITs lies in their investments: InvITs primarily focus on infrastructure projects, whereas REITs invest in income-generating real estate properties.

What is the difference between Mutual Funds and Infrastructure Investment Trust?

Unlike Mutual Funds that invest in a mix of equities, debt, or gold, Infrastructure Investment Trusts specifically invest in infrastructure projects. Thus, while Mutual Fund performance is tied to market trends, InvIT performance relies on the success of its invested infrastructure assets.

What are the potential risks associated with InvITs?

InvITs face several risks, including regulatory changes, inflation, asset risk due to long gestation periods of infrastructure projects, and uncertainties in the revenue stream from the infrastructure assets.

How many registered InvITs are there in India?

As on June 2023, there are 20 InvITs registered with SEBI.