The Laffer Curve is a theoretical representation that illustrates the relationship between tax rates and the amount of tax revenue collected by governments. The concept, named after economist Arthur Laffer, suggests that there is an optimal tax rate that maximizes revenue without discouraging productivity and economic growth. In this article, you will learn definition, theory, history, criticisms, etc.

This article will provide key insights for GS Paper-III Economy of UPSC IAS Exam.

Table of Content

- What is Laffer Curve?

- The theory of Laffer Curves

- Laffer Curve and the Tax Rate

- History of the Laffer Curve

- Criticisms of the Laffer Curve

- Frequently Asked Questions

- Conclusion

What is Laffer Curve?

- The Laffer Curve is a theory that demonstrates the connection between tax rates and the tax revenue collected by governments.

- The Laffer Curve was proposed by the economist Arthur Laffer in 1974.

- This curve is used to support the idea that reducing tax rates can lead to a rise in total tax revenue.

The theory of Laffer Curves:

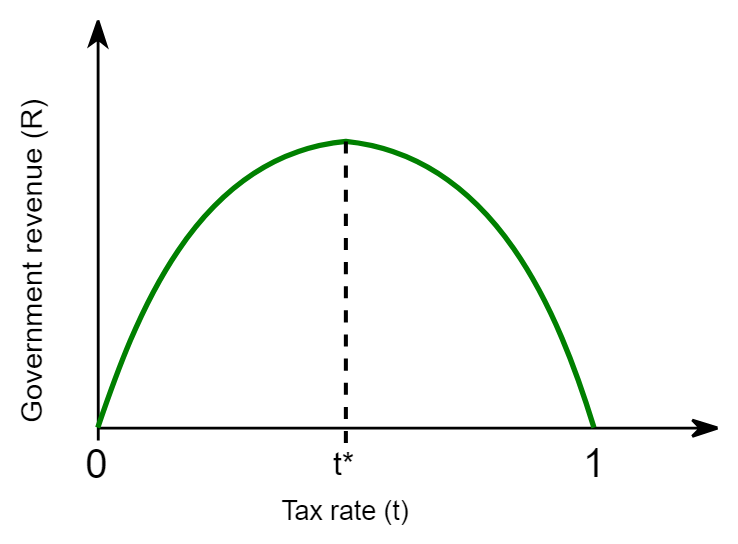

- It indicates that tax rates can be either too high or too low to generate maximum revenue, whereas at 0%- or 100%-income tax rates, tax receipts would be 0.

- According to Laffer, tax cuts impact the federal budget in two ways: arithmetic and economic.

- The arithmetic effect is immediate meaning that each cut madeon tax directly reduces the government revenue by the same amount.

- This diminishes the stimulative impact of government spending by the same amount.

- The economic effect is long-term and has a multiplier effect.

- As taxpayers receive more income due to tax cuts, they tend to spend it, leading to increased demand, business activity, production, and employment.

- This cycle ultimately reaches an optimal point, represented as T* on the graph.

- Beyond a certain limit, the motivation to produce more diminishes.

- On the left side of T*, raising the tax rate generates more revenue than is offset by the effect on worker and investor behavior.

- However, if tax rates go beyond T*, people may work less or not at all, resulting in reduced overall tax revenue.

- In cases where the current tax rate is to the right of T*, lowering the tax rate can stimulate economic growth by increasing work incentives and encourages investment, consequently boosting government revenue.

Laffer Curve and the Tax Rate:

- The Laffer Curve operates on a simple premise: tax revenue doesn’t always increase in direct proportion to the tax rate.

- When the tax rate is at 0%, the government doesn’t receive any revenue.

- However, if the government imposes a 100% tax rate, all earnings would go to the government and workers would have no incentive to be employed.

- Result: total revenue would decrease, as seen in the diminishing portion of the curve at the highest tax rate.

- The most efficient and ideal tax rate lies between 0% and 100%.

History of the Laffer Curve:

- Arthur Laffer has presented his ideas in 1974 to President Gerald Ford’s administration staff.

- Before the formulation of this theory, it was believed that increasing tax rates would lead to higher tax revenue.

- Laffer challenged this notion, asserting that if businesses were subjected to higher taxes, they would have less money available for investment, forcing them to protect their capital from taxation or even move their operations abroad.

- When workers saw a significant portion of their pay checks deducted for taxes, their motivation to work harder will diminish.

- According to Laffer, this decline in incentives to work and invest would ultimately lead to reduced total revenue as tax rates continued to rise, potentially causing harm to the economy.

- This idea had influenced President Ronald Reagan’s economic policy also known as Reaganomics, which embraced supply-side and trickle-down economics.

Trickle-down effect:

Criticisms of the Laffer Curve:

- Point of maximisation oftotal revenue: determining the exact point where total revenue is maximized is not practically possible.

- The graphical representation may lean towards one direction or the other, depending on specific circumstances and different economic conditions among countries.

- The Single Tax Rate: The tax system can be intricate, and increasing one tax rate may have consequences that offsets the advantages or disadvantages of reducing another tax.

- The Laffer curve simplifies the tax relationship by proposing a single, simplistic tax rate.

- Changes in the Ideal Tax Rate (T*): The Laffer Curve suggests an ideal tax rate between 0 and 100.

- However, this rate might change depending on economic circumstances.

- Tax Cuts for the Wealthy: The Laffer curve assumes a specific T* to maximize government revenue, by necessitating tax cuts for the wealthy.

- Assumptions about Individuals and Businesses: The Laffer curve supposes that higher taxes lead to lower revenues as companies might relocate and employees work fewer hours.

- However, employees may put in more effort or time for career growth.

- Businesses make decisions based not only on the tax rate but also other factors like a skilled workforce and infrastructure, which can counterbalance increased tax rate.

Conclusion

The Laffer Curve is a fundamental concept in economics that illustrates the relationship between tax rates and tax revenue. Named after economist Arthur Laffer, this theoretical model suggests that there is an optimal tax rate which maximizes government revenue without discouraging economic activity. The curve embodies the trade-off between tax rates and taxable income, proposing that both excessively high and very low tax rates can lead to decreased revenue for the government

Ref: Source-1

| Other Articles in Economy | |

| National Income of India | Mixed Economy |

| Privatization of Government Sector | G20 (Group of 20) |

| Aviation Industry in India | Cash Crops |

FAQs (Frequently Asked Questions)

What is Laffer Curve?

The Laffer Curve is a theoretical concept in economics that proposes a relationship between tax rates and the resulting government tax revenue.

What is the curve between tax rate and tax revenue?

Laffer curve analyses the relationship between tax rates and the tax revenue collected by the government.