The Lok Sabha passed the Finance Bill 2024, with significant amendments affecting Long-Term Capital Gains (LTCG) tax on immovable properties.

Key Amendments to LTCG Tax

- Relaxation of New Tax Regime: The amendment introduces an option for taxpayers to choose between a new lower LTCG tax rate or the old regime with indexation benefit.

- New LTCG Tax Rate: 12.5% without indexation.

- Old LTCG Tax Rate: 20% with indexation benefit.

- Applicability: Individuals or Hindu Undivided Families (HUFs) who acquired immovable properties before July 23, 2024.

- Previous Proposal: The original Budget 2024-25 proposal suggested eliminating the indexation benefit while lowering the LTCG tax rate to 12.5%.

Indexation Benefits

- Adjusts the purchase price of assets based on inflation.

- Aims to neutralize the impact of inflation on capital gains, thereby reducing the taxpayer’s overall tax liability.

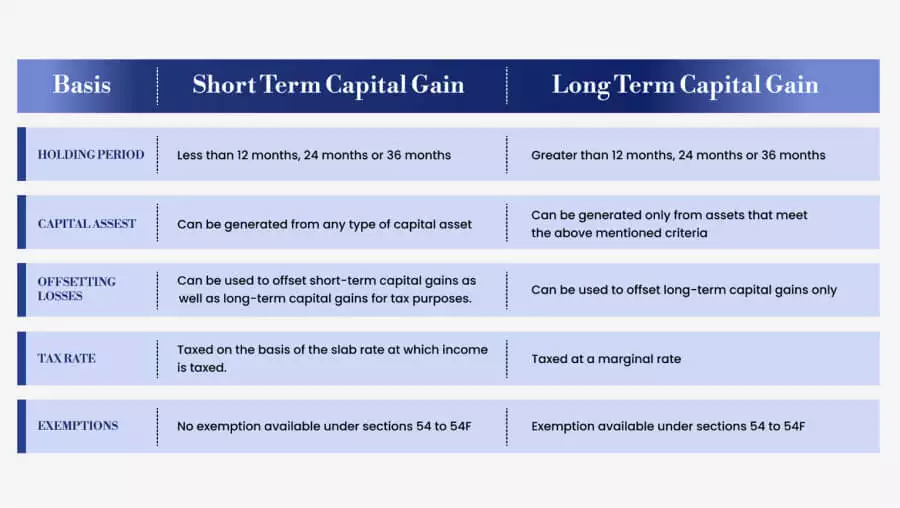

About Capital Gains (CG):

- Profits from the sale of capital assets (e.g., real estate, stocks, bonds).

- Considered as income and subject to capital gains tax.

- Short-term CG: For assets held less than a year (listed financial assets) or less than two years (unlisted financial assets and non-financial assets).

- Long-term CG: For assets held more than a year (listed financial assets) or at least two years (unlisted financial assets and non-financial assets).

About Capital Assets:

- Profits earned from the sale of capital assets such as real estate, stocks, and bonds.

- It includes land, buildings, vehicles, patents, trademarks, machinery, and jewellery.

- Also encompasses rights in Indian companies and associated legal rights.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Question:

What is the new LTCG tax rate on immovable properties?

The new LTCG tax rate is 12.5% without indexation benefit, as per the latest Finance Bill amendments.

Who can avail the option between the new and old LTCG tax regimes?

Individuals or Hindu Undivided Families (HUFs) who acquired immovable properties before July 23, 2024.

What is the old LTCG tax rate and its benefit?

The old LTCG tax rate is 20% with indexation benefit, allowing taxpayers to adjust for inflation and reduce their tax liability.

What was the previous proposal in the Budget 2024-25?

The original proposal suggested eliminating the indexation benefit while reducing the LTCG tax rate to 12.5%.

What is the purpose of indexation benefits in LTCG tax?

Indexation benefits help adjust the purchase price of assets based on inflation, aiming to reduce the impact of inflation on capital gains and lower the overall tax liability for taxpayers.