Monetary aggregates are measurements of the total money supply within an economy, with different types like M1, M2, M3, and M4 reflecting various levels of liquidity, or how easily the assets can be turned into cash. Understanding these aggregates is crucial as it can indicate an economy’s health and potentially warn of issues like high inflation. Over time, classifications have been expanded to include new monetary aggregates (NM1, NM2, and NM3) and liquidity aggregates (L1, L2, L3) for a more detailed view of the money supply and liquidity situation. In this article, you will know about meaning and definition of Money Aggregates, as well as old classification and new classification of various types of money supply in India. To explore more interesting UPSC Economy topics like Money Aggregates, check out other articles and IAS Notes of IASToppers.

Table of Content

- What are Money Aggregates?

- Old Classification of Monetary Aggregates

- New Classification of Monetary Aggregates

- Liquidity Aggregates: L1, L2, and L3

- Difference Between Monetary And Liquidity Aggregates

- Significance of Monetary Aggregates

- Conclusion

- FAQs on Monterey Aggregates

What are Monetary Aggregates?

- Monetary aggregates are the measures of money stock/supply in a country.

- In other words, monetary aggregates are the money circulating in an economy to satisfy its current monetary needs.

- Here, money is defined in terms of its degree of liquidity/moneyness.

- For the systematic measurement of monetary aggregates, the RBI appoints working groups on monetary aggregates from time to time to give recommendations on measurement of money aggregate.

In this regard, 3 working groups have been created so far:

- First Group on Money Supply (FWG) (1961)

- Second Working Group (SWG) (1977)

- Third Working Group on Money Supply: Analytics and Methodology of Compilation (WGMS) Chaired by Dr. Y.V. Reddy (1988)

Old Classification of Monetary Aggregates

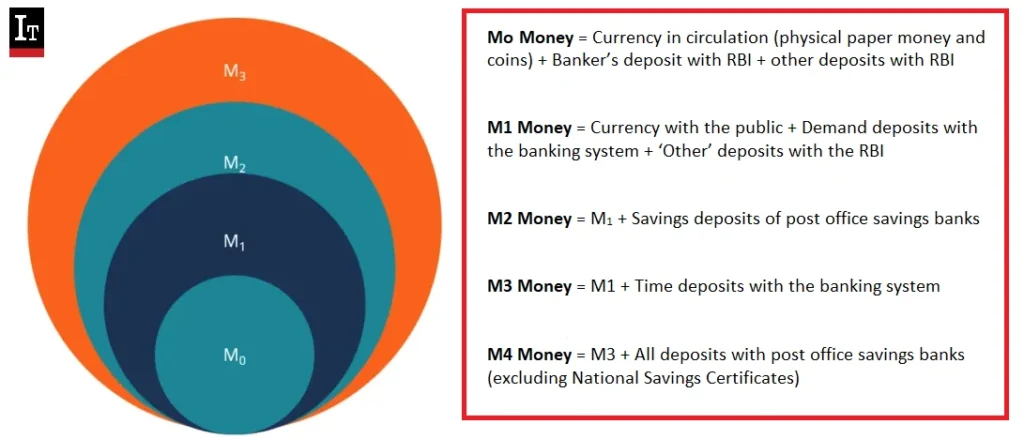

- Based on the recommendations of the Second Working Group, RBI has been publishing four monetary aggregates since 1977: M1, M2, M3 and M4, besides the reserve money (M0).

Reserve Money (M0)

- It is also known as Base Money or Reserve Money or High-Powered Money or Central Bank Money.

- M0Money = Currency in circulation (physical paper money and coins) + Banker’s deposit with RBI + other deposits with RB (such as account balances of foreign Central Banks and Governments as well as international agencies like the International Monetary Fund (IMF))

- Reserve Money holds the top most position in the RBI’s monetary Policy.

- Reserve Money is the total liability of the RBI.

- Since it is mostly currency in circulation with the people, reserve money decides the level of liquidity and price level in the economy.

- The weekly balance sheet data of RBI are used for the compilation of reserve money.

- The reserve money is compiled with a weekly periodicity.

Narrow Money (M1)

- Narrow money, also termed M1, covers only the most liquid assets which can be easily converted into cash for spending.

- M1 = Currency with the public + Demand deposits with the banking system + ‘Other’ deposits with the RBI

- Demand deposits with the banking system includes i) current deposits with the banking system and ii) the demand liabilities part of savings deposits with the banking system.

- Data on M1 are published on fortnightly basis by RBI.

Narrow Money (M2)

- M2 = M1 + Savings deposits of post office savings banks

- M2= M1 + Time liabilities of Savings Deposits with the Banking System + Certificates of Deposit issued by Banks + Term Deposits of inhabitants with a legally binding development of up to and incorporating 1 year with Banking System (barring CDs)

Broad Money (M3)

- M3 = M1 + Time deposits with the banking system

- M3 = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector.

- The balance sheet data for the entire banking sector which include apart from RBI, commercial and co-operative banks are used for compilation of M3 Money.

- M3 is computed fortnightly.

Broad Money (M4)

- M4= M3 + All deposits with post office savings banks (excluding National Savings Certificates)

New Classification of Monetary Aggregates

Following the recommendations of 3rd Working Group on Money Supply, RBI published a set of new monetary aggregates which are known as NM1, NM2 and NM3 (NM0 is known as base money).

- NM1 = Same definition as M1

- NM2 = NM1 + Short-term time deposits of residents (including and up to the contractual maturity of one year

- NM3 = NM2 + Long-term time deposits of residents + Call/Term funding from financial institutions

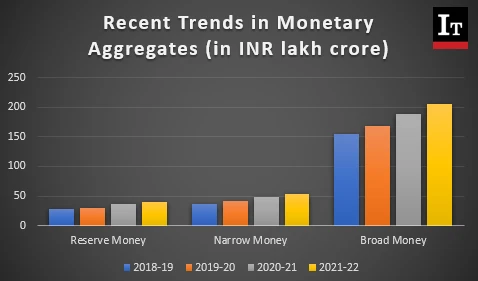

Recent Trends in Monetary Aggregates (in INR lakh crore)

| Year | Reserve Money | Narrow Money | Broad Money |

| 2018-19 | 27.70 | 37.10 | 154.32 |

| 2019-20 | 30.30 | 41.26 | 168.00 |

| 2020-21 | 36.00 | 47.94 | 188.45 |

| 2021-22 | 40.69 | 53.07 | 204.94 |

Liquidity Aggregates: L1, L2, and L3

The Working Group also recommended compilation of 3 liquidity aggregates namely: L1, L2 and L3.

- L1 = NM3 + All deposits with the post office savings banks (excluding National Savings Certificates).

- L2= L1 +Term deposits with term lending institutions and refinancing institutions (FIs) + Term borrowing by FIs + Certificates of deposit issued by FIs

- L3 =L2 + Public deposits of nonbanking financial companies

Data on L1 and L2 are published monthly, while it is published quarterly for L3.

Difference Between Monetary And Liquidity Aggregates

| Monetary Aggregates | Liquidity Aggregates | |

| Definition | These aggregates represent an expansive estimate of the money supply, including varied forms of money and financial assets. | This refers to financial investments that can be smoothly converted into cash. |

| Included Assets | Incorporates less liquid assets such as savings deposits, time deposits, and institutional money market funds. | Deals with highly liquid assets like cash, checking deposits, and money market instruments. |

| Purpose | Used to monitor the total growth of the money supply and to evaluate the effectiveness of the monetary policy. | Used to review the liquidity status of individuals, businesses, and financial institutions. |

| Examples | M1, M2, M3 etc. | Cash, checking accounts, and short-term, low-risk debt securities etc. |

Significance of Monetary Aggregates

- Examining monetary aggregates can provide meaningful information about a nation’s financial robustness and overall economic condition. For instance, rapid growth in monetary aggregates could indicate potential high inflation.

- In situations where there is more money in circulation than needed to purchase a fixed quantity of goods, price levels tend to increase. If inflation becomes a serious concern, central banks might need to increase interest rates or stop the growth of money supply.

Conclusion

Monetary aggregates play an instrumental role in monitoring the health and stability of an economy. These measures, constantly updated by financial institutions like the Reserve Bank of India, not only reflect the amount of money circulating but also its distribution in terms of liquidity. Understanding these indicators helps in making informed economic decisions, safeguarding against inflation, and enabling a balanced growth of an economy.

Ref: Source-1

| Other Articles in Economy | |

| Cash Management Bills (CMBs) | External Commercial Borrowing |

| Value Added Tax (VAT) | Financial Inclusion and Inclusive Growth |

| Financial Market | Laffer Curve |

FAQs (Frequently Asked Questions)

What are Monetary Aggregates?

Monetary aggregates are measurements of the total money supply in an economy, crucial for monitoring economic health and potential inflation.

What is the Key Difference between Old and New classification of Monterey Aggregates?

The new classifications (NM2 and NM3) base their measures on residency, excluding certain non-resident foreign currency deposits like FCNR(B) deposits, Resurgent India Bonds, and India Millennium Deposits.

How do Monetary Aggregates help in controlling inflation?

By monitoring the amount of money in circulation, monetary aggregates can help indicate potential high inflation, allowing central banks to take corrective actions like raising interest rates or curbing money supply growth.

What is m1 m2 m3 and m4 money supply?

m1 m2 m3 and m4 in economics are measure of money supply that shows various degrees of money liquidity in an economy, from physical currency and demand deposits (M1) to broader forms like time deposits and post office savings (M3, M4).

What is the difference between money aggregates m1, m2 and m3?

M1 includes the most liquid forms of money, such as physical currency and demand deposits. M2 extends to M1 and adds less liquid forms like savings deposits, while M3 includes M1 and M2, and adds even less liquid forms like time deposits with the banking system.

What are the components of money supply of m1 m2 and m3?

M1 comprises currency with the public and demand deposits. M2 adds savings deposits of post office savings banks to M1. M3 includes everything in M1 and M2 plus time deposits with the banking system.