Money Multiplier is key concept in understanding how monetary policy affects the economy.

Table of Content

- What is the Money Multiplier?

- How Does it Work?

- Calculation of the Money Multiplier

- Importance in the Economy

- Frequently Asked Questions (FAQs)

What is the Money Multiplier?

- The Money Multiplier refers to the mechanism by which the total money supply in an economy increases as a result of banks being able to lend more than the amount of the actual deposits they hold.

- It reflects the extent to which an increase in bank deposits can lead to a wider increase in the money supply.

How Does it Work?

- Initial Deposit: Imagine you deposit ₹10,000 in a bank. The bank doesn’t just hold this money; it uses most of it to issue loans.

- Reserve Ratio: Banks in India are required to keep a fraction of their deposits as reserves. This is known as the reserve ratio and is mandated by the Reserve Bank of India (RBI). Suppose the reserve ratio is 10%; the bank must then keep ₹1,000 of your deposit in reserve and can lend out the remaining ₹9,000.

- Lending Process: The ₹9,000 lent out eventually gets deposited into another account, where this second bank now lends 90% of these deposits, and the process continues. Each stage of lending and deposit creates additional bank deposits, effectively increasing the total money supply.

- Creation of Money: Through multiple rounds of lending, the original ₹10,000 deposit can significantly increase the total money supply in the economy. This cycle can, in theory, continue repeatedly.

Calculation of the Money Multiplier

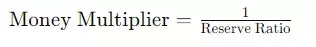

The Money Multiplier can be calculated using the formula:

With a reserve ratio of 10% (or 0.10), the Money Multiplier would be:

This means that every rupee of the reserve can support the creation of up to 10 rupees of bank money through deposits and loans.

Importance in the Economy

- The Money Multiplier is a key concept in understanding how monetary policy affects the economy.

- A lower reserve ratio increases the Money Multiplier, potentially expanding economic activity by enabling more lending.

- Conversely, a higher reserve ratio can reduce the multiplier, helping to control inflation by restricting the money supply.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Questions (FAQs)

What is the reserve ratio?

The reserve ratio is the percentage of total deposits that a bank is required to keep in reserve and cannot lend out. In India, this ratio is set by the Reserve Bank of India (RBI) and is a crucial tool in monetary policy to control the money supply.

How does the money multiplier affect inflation?

The money multiplier can have a significant impact on inflation. If banks lend more, it increases the money supply, which can lead to higher spending and potentially higher prices, thus increasing inflation. Conversely, a lower multiplier reduces the money supply, which can help control inflation.

Can the money multiplier be less than 1?

Yes, the money multiplier can be less than 1 if the reserve ratio is above 100%, but in practical terms, central banks maintain reserve ratios that support a multiplier greater than 1 to encourage lending and economic growth.

How does the RBI control the money multiplier?

The RBI can adjust the reserve ratio to control the money multiplier. Lowering the reserve ratio increases the multiplier, allowing banks to lend more of their deposits, thereby increasing the money supply. Raising the reserve ratio decreases the multiplier, reducing the money supply.

What is the difference between the money multiplier and the credit multiplier?

The money multiplier focuses on the increase in total bank money through deposits and loans based on the reserve ratio. The credit multiplier, however, refers to the total amount of credit created in the economy as a result of the banking sector’s ability to lend.