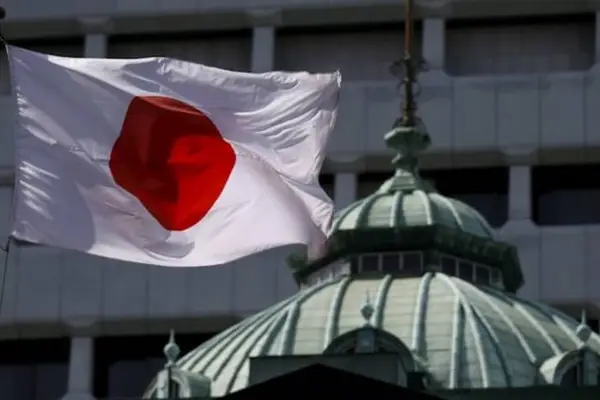

The Bank of Japan recently raised its key interest rates, stepping away from the country’s negative interest rate policy for the first time in 17 years.

What are negative interest rates?

- Negative interest rates occur when borrowers are credited interest, rather than paying interest to lenders.

- This is when central banks make their commercial counterparts pay to park their excess cash at the institution.

- This method is usually adopted during deflationary periods when consumers hold too much money instead of spending as they wait for a turnaround in the economy.

- Consumers may expect their money to be worth more tomorrow than today during these periods.

- When this happens, the economy can experience a sharp decline in demand, causing prices to fall even lower.

- According to experts, banks use the money to lend more to businesses and consumers to increase financial growth and avoid the charges for parking the cash.

- These negative interest rates were first introduced by Swedish Riksbank in 2009, followed by the central banks of Denmark, Switzerland, and Japan.

What are the Risks of Negative Interest Rates?

- Negative interest rates should help to stimulate economic activity and delay inflation.

- However, some policymakers advise against it due to negative consequences or backfiring of inflation.

- In the case of mortgages, the loans are contractually tied to the prevailing interest rate, so negative rates could squeeze profit margins to the point where banks lend less.

- There is no way to stop deposit holders from withdrawing their money and filling in the physical cash for saving money in banks.

- While the initial threat would be a run on banks, the drain of cash from the banking system could lead to a rise in interest rates.

- It would lead to opposite consequences from the main aim of negative interest rates.

Why did Japan introduce negative interest rates and what are its impacts?

- Japan introduced negative interest rates in 2016 as a new measure to tackle long-time deflation or declining prices.

- It was expected to encourage spending and inflation in an ageing society with a negative population growth.

- Moreover, the authorities believed that it would help in keeping the country’s debt repayments manageable, as it floated above 100% of itsGross Domestic Product (GDP).

- It would have helped to prevent deeper deflation in the economy, but affected the economy during the COVID-19 pandemic and the fallout from Russia’s war in Ukraine.

- Prolonged use of such negative interest rates, decreased banks’ profitability and helped push down the value of the yen.

- The negative interest rate policy, combined with other measures to inject money into the economy and keep borrowing costs low.

Ref:Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |