Keynesian economists argue that a rise in individuals’ savings, a phenomenon known as the ‘Paradox of Thrift,’ by reducing the amount of money that is spent on final goods and services, can in effect cause a significant fall in overall savings and investment.

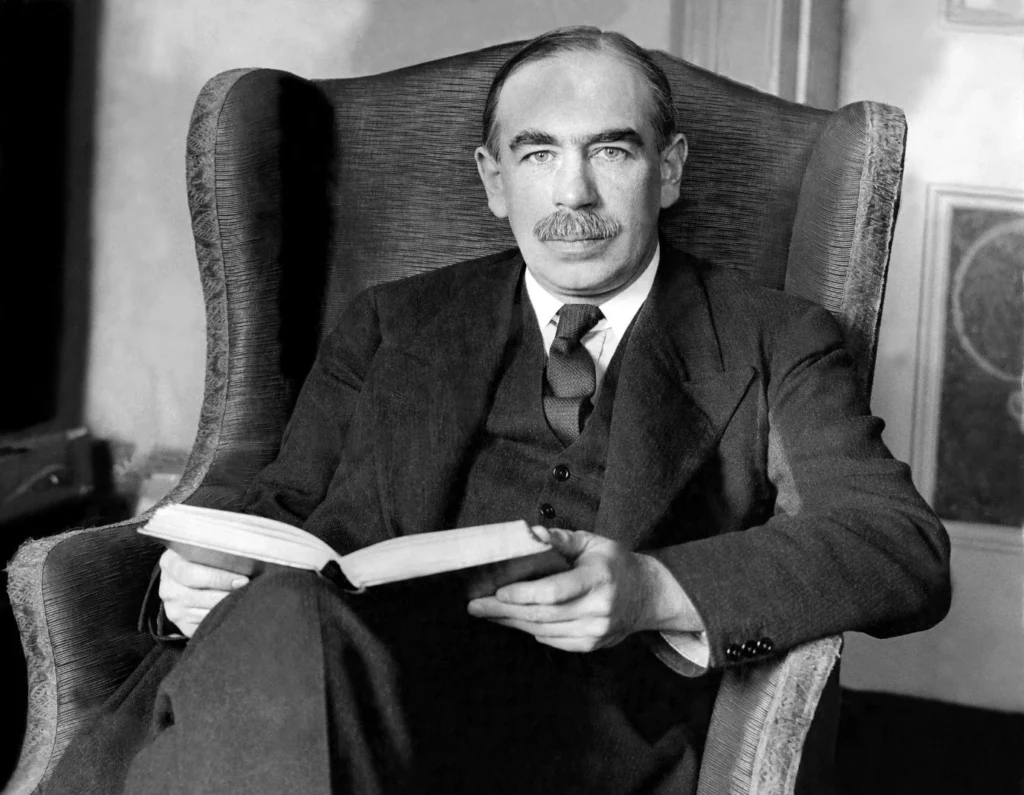

- The Paradox of Thrift theory, coined by economist John Maynard Keynes, posits that heightened personal savings during economic recessions can dampen economic growth by decreasing aggregate demand.

- Keynes argued that while saving may seem prudent on an individual level during economic hardships, collectively, increased saving can exacerbate economic downturns by suppressing consumption and investment, leading to reduced economic activity.

- A rise in individuals’ savings diminishes spending on goods and services, consequently impacting overall savings and investments negatively.

- According to the theory, higher savings rates are detrimental to the broader economy, which relies on robust consumer spending to drive growth.

Criticisms of PoT:

- Neglects Banking Role: Critics argue that the theory overlooks the role of banks, which can lend out saved income, thereby stimulating economic activity by lowering interest rates and increasing lending and spending.

- Omits Inflation and Deflation: Another criticism is the theory’s failure to account for inflation and deflation dynamics within an economy, which can influence the effectiveness of saving and spending behaviors.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |