Two fintech startups recently received the final licence from the Reserve Bank of India (RBI) to operate as payment aggregators.

About Payment Aggregators:

- A payment aggregator is a third-party service provider that enables customers to make and businesses to accept payments online.

- They enable their clients to accept various payment methods such as debit cards, credit cards, cardless EMIs, UPI, bank transfers, e-wallets, and e-mandates.

Features of Payment Aggregators:

- Sub-Merchant Account: PAs assist in setting up sub-merchant accounts, allowing businesses to accept payments. Without such accounts, transactions cannot be processed.

- Documentation: To create a sub-merchant account, businesses need to provide documents like proof of business address, bank account statements, and PAN card details.

- There may beKYC procedures involved in the onboarding process.

- Efficient Onboarding: A reliable payment aggregator can expedite the merchant onboarding process, often completing it within a few days.

- Payment aggregators prioritize security to prevent fraud and safeguard customer data.

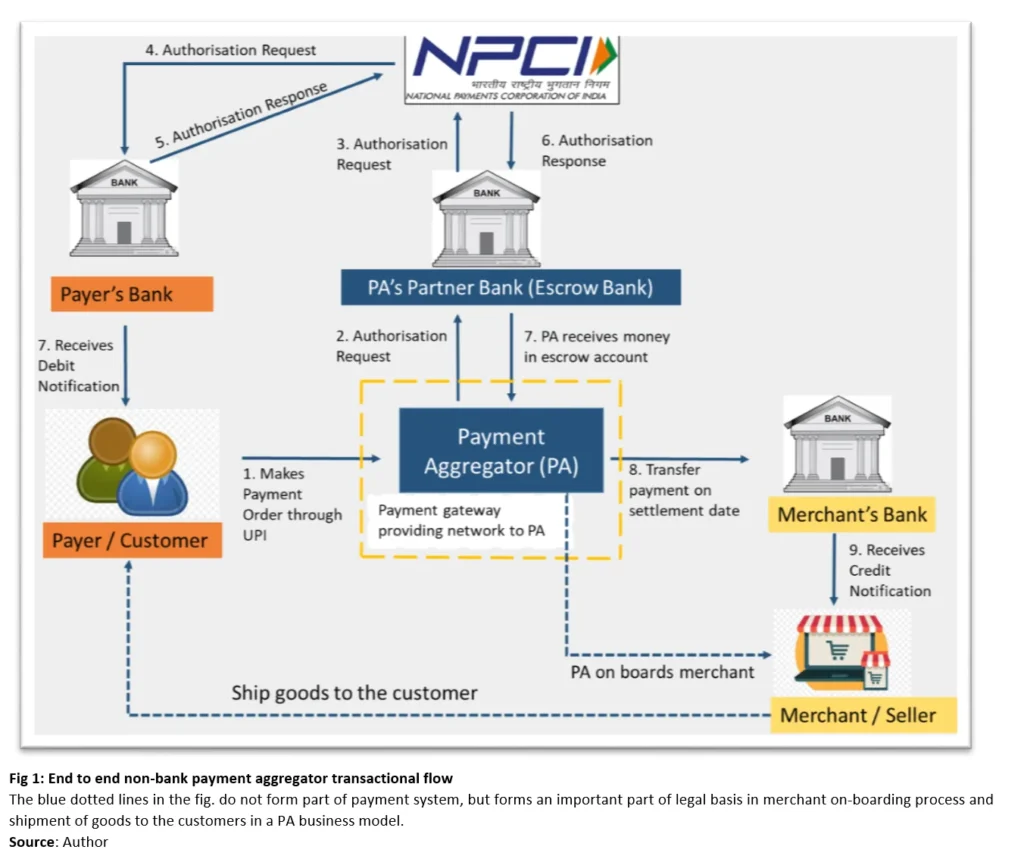

Working of Payment Aggregator:

- Payment aggregators provide businesses with a simplified way to accept payment from multiple sources.

- First, the business creates an account with the payment aggregator, which provides them with merchant accounts to accept payments.

- When they are ready to purchase, they head to the checkout page and select their preferred payment method.

- The acquiring bank receives the transaction information from the merchant.

- The card company then runs a fraud check to ensure the transaction is legitimate.

- Issuer accepts or declines the transaction and sends funds to the acquiring bank.

- The acquiring bank requests the funds from the card issuer, which are then transferred to the merchant`s account.

Types of Payment Aggregators in India:

- Third-party payment aggregator: These independent companies provide payment aggregation services to businesses.

- They partner with multiple payment providers to offer their customers a range of payment options.

- Bank payment aggregators: these are payment aggregators that are owned and operated by banks.

- They offer a more limited range of payment options but may be preferred by businesses prioritizing security and reliability.

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |