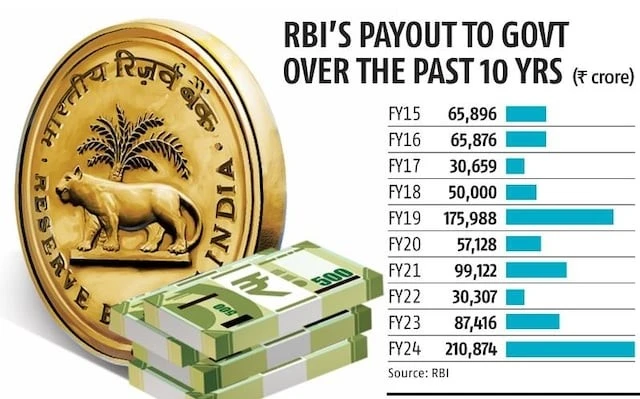

The Reserve Bank of India (RBI) approved the transfer of Rs 2.1 trillion (Rs 2,10,874 crore) as surplus to the central government for the accounting year 2023-24.

About Surplus Transfer and Economic Capital Framework (ECF):

- Surplus transfer refers to the transfer of the Reserve Bank of India’s (RBI) surplus earnings to the Government of India.

- This transfer includes the surplus from the RBI’s income and any excess provisions identified as per the Economic Capital Framework (ECF).

- The largest recorded transfer was ₹1.76 lakh crore in 2019, which included ₹1.23 lakh crore of annual surplus and ₹52,637 crore of excess provisions .

Economic Capital Framework (ECF):

- The ECF determines the optimal level of risk provisions and surplus transfer from the RBI to the government.

- It was introduced based on the recommendations of the Bimal Jalan Committee to balance the need for maintaining adequate risk buffers and transferring surplus to the government.

- ECF aims to ensure the RBI has sufficient financial resilience while allowing for surplus distribution.

Ways by Which RBI Earns Its Profit:

- Interest on Government Securities: RBI earns a significant portion of its income from the interest on the government securities it holds.

- Foreign Exchange Operations: Profits from buying and selling foreign currencies, which helps manage the exchange rate and stabilize the currency.

- Lending to Banks: Interest from loans provided to commercial banks under various facilities like the Liquidity Adjustment Facility (LAF).

- Management of Foreign Exchange Reserves: Earnings from investments in foreign securities using India’s foreign exchange reserves.

- Fee-Based Services: Income from providing services such as managing the government’s borrowing program, and other financial services to the banking sector.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |