The Reserve Bank of India (RBI) is set to explore tokenisation of assets and government bonds as part of its wholesale Central Bank Digital Currency (CBDC) pilot project.

- CBDC is the digital form of a country’s fiat currency, which is regulated by its central bank.

About Tokenisation of Assets:

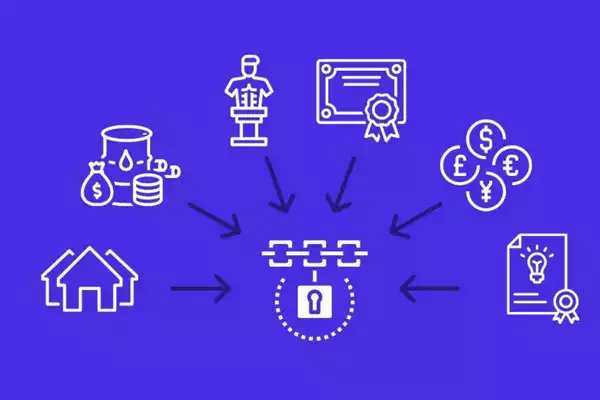

- Tokenisation is the process of issuing a digital representation of an asset on a (typically private) blockchain.

- The assets under tokenization can include real estate or art, financial assets like equities or bonds, nontangible assets like intellectual property, or even identity and data.

- Benefits:

- Faster transaction settlement

- Operational cost savings

- Democratization of access

- Enhanced transparency powered by smart contracts

- Cheaper and more nimble infrastructure

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |