The Reserve Bank of India (RBI) is set to launch the Unified Lending Interface (ULI) soon, following its successful pilot project last year.

About Unified Lending Interface (ULI):

- Definition: ULI is a technology platform designed to enhance the efficiency of the lending process.

- Objective: To provide a seamless, consent-based flow of digital information, including land records from multiple states, to lenders, similar to the impact of UPI on payments.

- Purpose: To reduce costs, accelerate disbursement, and ensure scalability in lending processes.

Key Features of ULI

- Seamless Credit Flow: Facilitates frictionless credit by minimizing the time for credit appraisal.

- Digital Information Exchange: Includes access to diverse data, such as land records and other relevant financial and non-financial information.

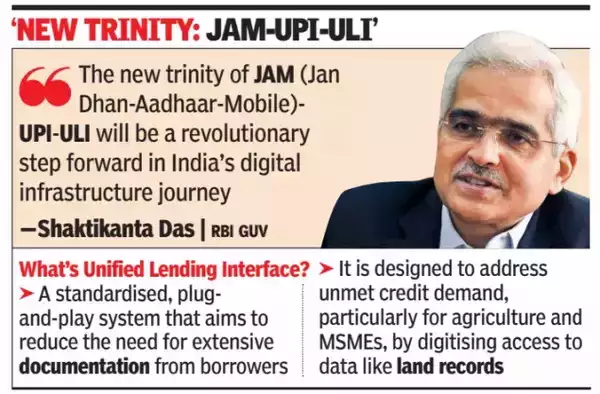

- Standardized APIs: Utilizes common, standardized Application Programming Interfaces (APIs) for a ‘plug and play’ approach, reducing technical complexities for lenders.

Benefits of ULI

- Improved Credit Access: Addresses the unmet credit demand, particularly benefiting agricultural and MSME (Micro, Small, and Medium Enterprises) sectors.

- Quicker Turnaround: Accelerates the credit delivery process by reducing the need for extensive documentation.

- Enhanced Efficiency: Reduces costs and increases the efficiency of the lending process.

Significance

- Digital Infrastructure: ULI is expected to play a transformative role in India’s digital infrastructure, akin to the revolution brought by UPI in payments.

- New Trinities: ULI, alongside JAM (Jan Dhan-Aadhaar-Mobile) and UPI, will form a crucial part of India’s digital ecosystem.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Question:

What is the Unified Lending Interface (ULI)?

The ULI is a technology platform designed to streamline the lending process by enabling seamless flow of digital information to lenders.

What is the main objective of ULI?

The main objective of ULI is to provide a consent-based, frictionless flow of information to lenders, similar to the impact of UPI on payments.

How does ULI reduce costs in lending processes?

ULI reduces costs by accelerating the disbursement process and minimizing the time for credit appraisal through seamless credit flow.

What kind of data can lenders access through ULI?

Lenders can access diverse data through ULI, including land records and other relevant financial and non-financial information for informed decision-making.

How does ULI ensure scalability in lending processes?

ULI ensures scalability in lending processes by utilizing standardized APIs for a \’plug and play\’ approach, enabling easy integration and reducing technological barriers.