Universal Basic Income is a bold and ambitious idea aimed at addressing economic inequality and providing a safety net for all citizens. While it has potential benefits, it also faces significant challenges and criticisms that need to be carefully considered and addressed. The concept is designed to ensure that everyone has a minimum level of income to cover basic living expenses, regardless of their employment status or other income sources. In this article, you will know about meaning, scope, pros and cons of Universal Basic Income, especially in India. To explore more interesting UPSC Economy topics of GS Paper -3 like Universal Basic Income (UBI), check out other articles and IAS Notes of IASToppers.

Table of Content

- What is Universal Basic Income?

- What are guiding principles for setting up a Universal Basic Income?

- Why is Universal Basic Income not feasible in India?

- Arguments for and against Universal Basic Income

- Challenges and Criticisms

- What are Alternatives of Universal Basic Income?

- Way Forward

- Conclusion

- FAQs

What is Universal Basic Income (UBI)?

- Universal Basic Income (UBI) is a social protection program designed to provide a regular, unconditional sum of money to all residents, regardless of their income or employment status.

- In India, the concept has gained momentum over the past few decades as a potential tool to support the country’s most vulnerable populations.

- It has the potential to reduce income inequality, and stimulate economic growth by increasing disposable income among lower-income groups.

Key Aspects of Universal Basic Income:

- Unconditional: Unlike welfare programs that may require recipients to meet certain criteria (such as being unemployed, disabled, or having low income), Universal Basic Income is given to everyone without any conditions.

- Regular Payments: Universal Basic Income payments are made on a regular basis, such as monthly or annually, ensuring a steady income stream for recipients.

- Universal Coverage: The idea is to provide the income to all citizens or residents of a country, making it a universal benefit.

- Fixed Amount: The amount provided is typically fixed and is intended to cover basic necessities like food, housing, and utilities.

Goals of Universal Basic Income

- Poverty Reduction: By providing a basic income floor, Universal Basic Income aims to reduce poverty and provide financial security to everyone.

- Economic Stability: Universal Basic Income can potentially stabilize the economy by ensuring that everyone has enough money to meet their basic needs, which can increase consumer spending and boost economic activity.

- Simplification of Welfare Systems: A Universal Basic Income could simplify the welfare system by replacing various need-based programs with a single, universal payment, reducing administrative costs and complexity.

- Empowerment and Freedom: With a guaranteed income, individuals might have more freedom to pursue education, change careers, or start businesses without the immediate pressure of financial survival.

Examples and Experiments

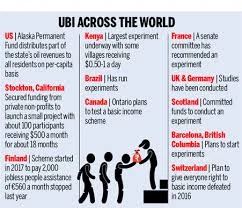

- Finland: Conducted a two-year Universal Basic Income experiment from 2017 to 2018, providing a random sample of unemployed individuals with a regular income without conditions.

- United States: Several cities and states have explored Universal Basic Income through pilot programs, such as Stockton, California’s SEED project.

- Canada: The city of Ontario ran a basic income pilot project from 2017 to 2019.

What are the Guiding Principles for Setting up a Universal Basic Income?

This approach aims to balance the theoretical appeal of Universal Basic Income with the practical challenges of implementation in a diverse and complex country like India.

i) De jure Universality, De facto Quasi-Universality

- While implementing, targeting from an ‘exclusion of the non-deserving’ perspective than the current inclusion of the deserving perspective could be adopted.

- Challenges: Balancing universality and fiscal costs, Avoiding resistance due to perception of inequity.

- Conflict with JAM: These methods may conflict with JAM’s appeal of direct, costless transfers.

Strategies for Exclusion of Non-Deserving:

- Asset-Based Exclusion: Exclude individuals based on ownership of key assets such as automobiles or air-conditioners, or based on high bank balances.

- Opt-Out Scheme: Implement a ‘give it up’ scheme where the non-deserving can choose to opt out and receive credit for doing so.

- Public Disclosure: Display the list of Universal Basic Income beneficiaries publicly to “name and shame” the wealthy who opt to receive Universal Basic Income.

- Self-Targeting: Require regular verification from beneficiaries, assuming the wealthy would not find it worthwhile due to higher opportunity costs.

ii) Gradualism

- Principle: Adopt Universal Basic Income gradually, in a phased manner, to assess costs and benefits at each step.

- Phased Adoption Approaches:

- Offer Universal Basic Income as a choice in place of existing entitlements to provide agency to people and improve existing program performance.

- Concerns: May perpetuate current targeting issues and misallocation problems; could be administratively cumbersome.

iii) UBI for Women:

- Target Universal Basic Income to women to reduce fiscal costs and have large multiplier effects on households.

- Potential Problems: Difficulty in identifying the number of children in households, possible encouragement of higher birth rates, challenges in phasing out boys as they reach adulthood.

Universalize Across Vulnerable Groups:

- Initially target vulnerable groups such as widows, pregnant mothers, the elderly, and the infirm.

- Concerns: Existing exclusion errors, lower access to bank accounts among these groups.

Redistributive Resource Transfers to States:

- Directly transfer part of redistributive resources to beneficiaries in pilot Universal Basic Income programs in states receiving large transfers.

- Concerns: These states might have limited state capacity, although they have made progress in financial inclusion.

Concept and Frameworks of Universal Basic Income in India

- Universal Basic Income frameworks proposed in India vary, with some suggesting a basic income tied to the poverty threshold, while others propose a fixed amount for every citizen.

- The Universal Basic Income and existing welfare schemes like the Public Distribution System (PDS) and the MGNREGA if integrated, can ensure that the most disadvantaged groups benefit the most.

- A committee was formed to study UBI’s economic viability and its potential impact on poverty alleviation, wealth inequality, and economic growth, as well as its practicality and sustainability.

Why is Universal Basic Income not feasible in India?

- The ongoing debate around UBI in India is driven by perspectives and analyses of various economists and institutions, including the International Monetary Fund (IMF).

- The IMF’s Fiscal Monitor has highlighted the potential for Universal Basic Income to replace inefficient subsidies with a more straightforward and equitable system.

- However, the feasibility and implications of implementing Universal Basic Income in India remain contentious.

IMF’s Perspective on Universal Basic Income in India

- The IMF suggested that the fiscal space equivalent to the cost of India’s public distribution system and energy subsidies in 2011-12 could finance an annual UBI of Rs 2,600 per person.

- This amount is about 20% of the median per capita consumption for that year and would cost around 3% of GDP.

- This proposal does not account for recent subsidy reforms, but it highlights the possibility of reallocating existing resources to fund UBI.

Arguments for and against Universal Basic Income

Arguments for Universal Basic Income

- Addressing Systemic Inefficiencies: Current subsidy systems in India face inefficiencies, corruption, and leakage, which can be tackled through Universal Basic Income through direct cash transfers.

- Poverty Alleviation: Universal Basic Income could provide a basic income floor that ensures everyone can meet their essential needs, thus reducing poverty and inequality.

- Administrative Simplification: Replacing various targeted welfare schemes with a single Universal Basic Income payment could reduce administrative costs and complexities.

- Welfare Gains: As noted in the 2016-17 Economic Survey, even a relatively low Universal Basic Income could yield significant welfare gains by providing financial security and reducing poverty.

Arguments Against Universal Basic Income

Fiscal Capacity:

- The Economic Survey of 2016-17 estimated that providing Rs 7,620 per year to 75% of the population would cost about 5% of GDP.

- Economist Pranab Bardhan estimated that an inflation-indexed Universal Basic Income of Rs 10,000 would cost about 10% of GDP.

Political Challenges:

- Rolling back existing subsidies to create fiscal space for Universal Basic Income is politically challenging. Subsidies often have strong political support, and reducing them could be difficult.

Labour Market Distortions:

- A guaranteed income without work requirements might reduce labour participation and mobility.

- Similar effects were observed after implementing the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), which led to increased wages without a corresponding rise in productivity, potentially affecting competitiveness and economic growth.

Frameworks of Universal Basic Income in India

- Universal Basic Income frameworks proposed in India vary, with some suggesting a basic income tied to the poverty threshold, while others propose a fixed amount for every citizen.

- The Universal Basic Income and existing welfare schemes like the Public Distribution System (PDS) and the MGNREGA if integrated, can ensure that the most disadvantaged groups benefit the most.

- A committee was formed to study UBI’s economic viability and its potential impact on poverty alleviation, wealth inequality, and economic growth, as well as its practicality and sustainability.

Potential Benefits of Universal Basic Income

- Poverty Alleviation: Universal Basic Income can provide a financial safety net for the poor, ensuring a minimum level of income that can help meet basic needs.

- Economic Growth: By increasing disposable income, Universal Basic Income can boost consumer spending, driving demand and economic growth.

- Reduction in Inequality: A universal payment can help reduce income disparities by providing financial support to those at the lower end of the income spectrum.

- Administrative Efficiency: Universal Basic Income can simplify the welfare system by replacing multiple targeted programs with a single, unconditional cash transfer, reducing administrative costs and leakages.

Challenges and Criticisms

- Affordability: Implementing Universal Basic Income in a populous country like India would require substantial financial resources, which may be challenging given existing fiscal constraints.

- Providing a basic income to all citizens can be extremely expensive, and funding it might require significant changes in tax policies or reallocation of government spending.

- Complex Implementation: Reforms to the current welfare system would be necessary, including developing new technology and infrastructure to distribute and monitor payments.

- Political and Administrative Hurdles: Universal Basic Income is a contentious policy, requiring the cooperation and coordination of various political parties and government agencies.

- Leakages, Fraud, and Corruption: Ensuring that UBI payments reach the intended recipients without being siphoned off by corruption is crucial.

- Behavioral Changes: There is concern that unconditional payments might reduce the incentive to work and foster dependency.

- Inflation Risk: If not managed properly, the influx of cash into the economy could lead to inflation, eroding the value of the payments.

- Work Incentives: Critics argue that Universal Basic Income might reduce the incentive to work, potentially leading to a decrease in the labor force participation rate.

- Equity and Fairness: Some argue that it might not be fair to give the same amount of money to everyone, regardless of their existing income or wealth.

Case Studies and Pilot Programs

- Economic Survey 2016: Itproposed a Universal Basic Income scheme that would provide Rs. 7,620 annually to the poorest 75% of Indian households.

- The scheme was to be funded through austerity measures, higher income taxes on the wealthy, and a universal carbon tax. However, the government did not implement this proposal.

- SEWA Pilot in Madhya Pradesh: It provided a monthly basic income of Rs. 750 to around 6,000 participants by the state legislature and the Self-Employed Women’s Association (SEWA).

- Despite positive outcomes, such as increased spending on food, healthcare, and education, the program was discontinued due to funding issues.

- Nyuntam Aay Yojana (NYAY): Proposed by Congress in 2019, this scheme aimed to provide Rs. 6,000 per month to poor families.

- KALIA Scheme in Odisha: Provides cash support to farmers to reduce costs and invest in income-generating activities.

- Targeted Cash Transfers: States like Madhya Pradesh, Karnataka, and Tamil Nadu have introduced schemes targeting specific groups, such as women or farmers.

What are the Alternatives to Universal Basic Income?

- Negative Income Tax (NIT): Provides financial support to those earning below a certain threshold, ensuring a minimum income level.

- Guaranteed Minimum Income (GMI): Offers income support targeted at the poorest individuals, ensuring basic needs are met.

- Job Guarantee Programs: The government ensures employment opportunities for all citizens, often focusing on public works and community services.

- Conditional Cash Transfers (CCT): Provides financial aid to low-income families contingent upon certain behaviors, like ensuring children attend school or receive vaccinations.

- Social Security Expansion: Enhances existing welfare programs like unemployment benefits, food stamps, and housing assistance, to cover more people and provide substantial support.

- Earned Income Tax Credit (EITC): Provides tax credits to low and moderate-income workers, supplementing their earnings and incentivizing employment.

- Progressive Taxation: Implements higher taxes on the wealthy to fund social welfare programs and reduce income inequality.

- Universal Basic Services (UBS): Guarantees access to essential services like healthcare, education, and housing, reducing the need for cash transfers.

- Living Wage Laws: Ensures all workers receive a wage sufficient to cover basic living expenses, reducing reliance on welfare programs.

- Asset-Building Programs: Helps low-income individuals build financial assets through matched savings accounts, microfinance, and affordable housing initiatives.

Way Forward

While Universal Basic Income holds potential for reducing poverty and income inequality in India, its implementation must be carefully designed and financially sustainable. Key considerations include:

- Affordability and Funding: Ensuring that the scheme is financially viable without compromising other essential services.

- Minimizing Leakages: Designing robust systems to prevent fraud and corruption.

- Encouraging Employment: Structuring payments to avoid disincentivizing work.

- Monitoring and Evaluation: Continuously assessing the program’s impact and making necessary adjustments.

- Before making a final decision, the government’s advisory board must thoroughly evaluate the pros and cons of Universal Basic Income.

- Its implementation could significantly impact millions of lives, making it essential to proceed with caution and ensure equitable outcomes.

Conclusion

Universal Basic Income (UBI) represents a transformative approach to social welfare and economic redistribution that could potentially address some of India’s most persistent challenges, such as poverty, inequality, and unemployment. By guaranteeing a fixed income to every citizen, irrespective of their employment status or income level, Universal Basic Income aims to provide a safety net that empowers individuals to make life choices without the immediate pressures of financial survival. It also promises to streamline the bureaucracy associated with welfare schemes and reduce corruption. However, the feasibility of implementing Universal Basic Income in a diverse and populous country like India hinges on careful consideration of its financial implications and the risk of potential disincentives for work. While Universal Basic Income is not a panacea for all economic issues, it could be a crucial step towards fostering a more inclusive and equitable society, provided it is tailored thoughtfully to the Indian context and implemented alongside complementary reforms in education, healthcare, and infrastructure.

Ref: Source-1

| Other Articles in Economy | |

| Mixed Economy | Small Finance Banks (SFB) |

| Basel Norms – I, II and III | Goods and Services Tax Council |

| G20 (Group of 20) | Minimum Support Price (MSP) in India |

FAQs (Frequently Asked Questions)

Which country had started universal basic income?

For a short period of time, Iran and Mongolia had universal basic income. Currently, no countries in the world have universal basic income.

Who created the idea of UBI?

Thomas Spence had suggested the idea of UBI.