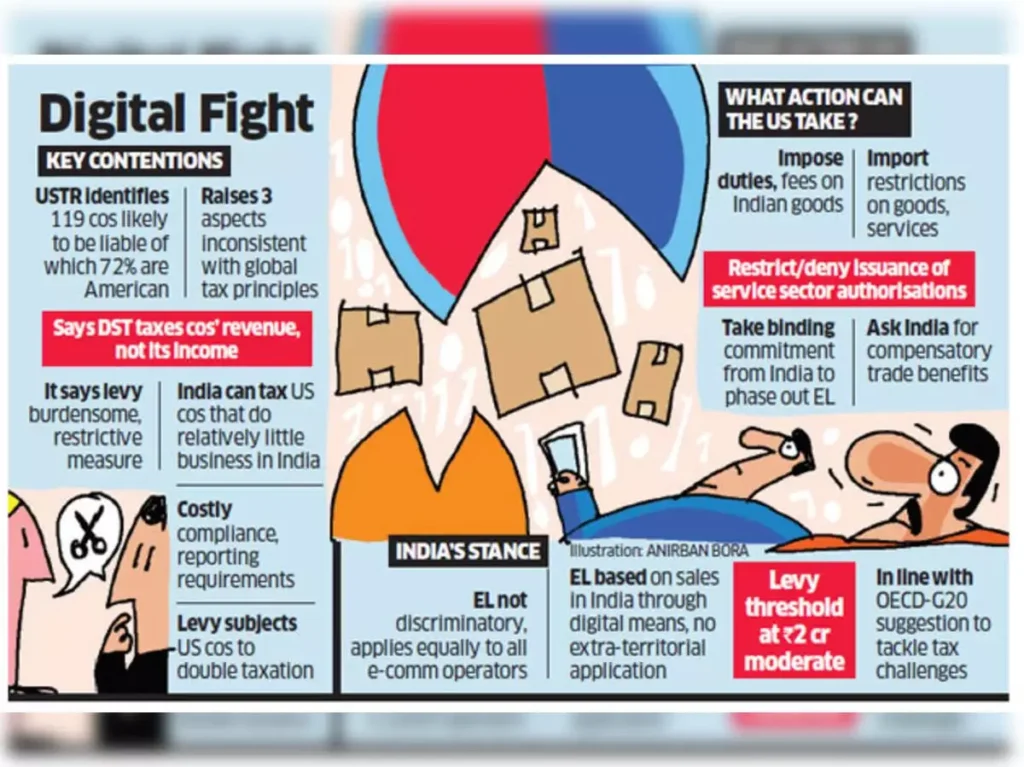

The government proposes withdrawing a 2% equalisation levy on non-resident e-commerce companies.

About Equalisation Levy:

- Introduced in 2016, the Equalisation Levy was initially applied at a 6% rate to online advertisements and related payments for digital ad space.

- This was targeted at non-residents operating without a permanent establishment in India.

- In 2020, the scope of this levy was broadened to encompass e-commerce supplies or services provided to Indian residents by non-resident e-commerce operators.

- This expansion included a 2% levy, applicable to non-resident e-commerce operators who have a permanent establishment in India.

- Purpose: The levy aims to promote fair competition and reasonableness, and to enhance the government’s capacity to tax businesses that operate in the digital domain.

- The levy is part of the broader BEPS (Base Erosion and Profit Shifting) Action Plan, intended to address tax challenges that have arisen due to the evolution of digital business models and the significant reliance on digital and communication networks.

- It does not fall under the Income Tax Act of India but is governed by Chapter VIII of the Finance Act of 2016.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |

Frequently Asked Questions (FAQs)

What is the scope of the Equalisation Levy introduced in 2016?

The levy initially applied to online advertisements and related payments for digital ad space, targeting non-residents without a permanent establishment in India.

Why was the Equalisation Levy broadened in 2020?

The scope was expanded to include e-commerce supplies or services provided to Indian residents by non-resident e-commerce operators, with a 2% levy for those with a permanent establishment in India.

What is the purpose of the Equalisation Levy?

The levy aims to promote fair competition and reasonableness, enhancing the government’s ability to tax businesses operating in the digital domain.

What broader initiative does the Equalisation Levy align with?

The levy is part of the BEPS Action Plan, addressing tax challenges from evolving digital business models and significant reliance on digital networks.

Does the Equalisation Levy fall under the GST regime?

No, the levy does not fall under the GST regime and is separate from the existing tax structure.