Pine Labs and Udaan are among the latest companies planning to ‘reverse flipping’ their holding companies to India, joining a trend observed among well-funded and highly valued startups.

About Reverse flipping:

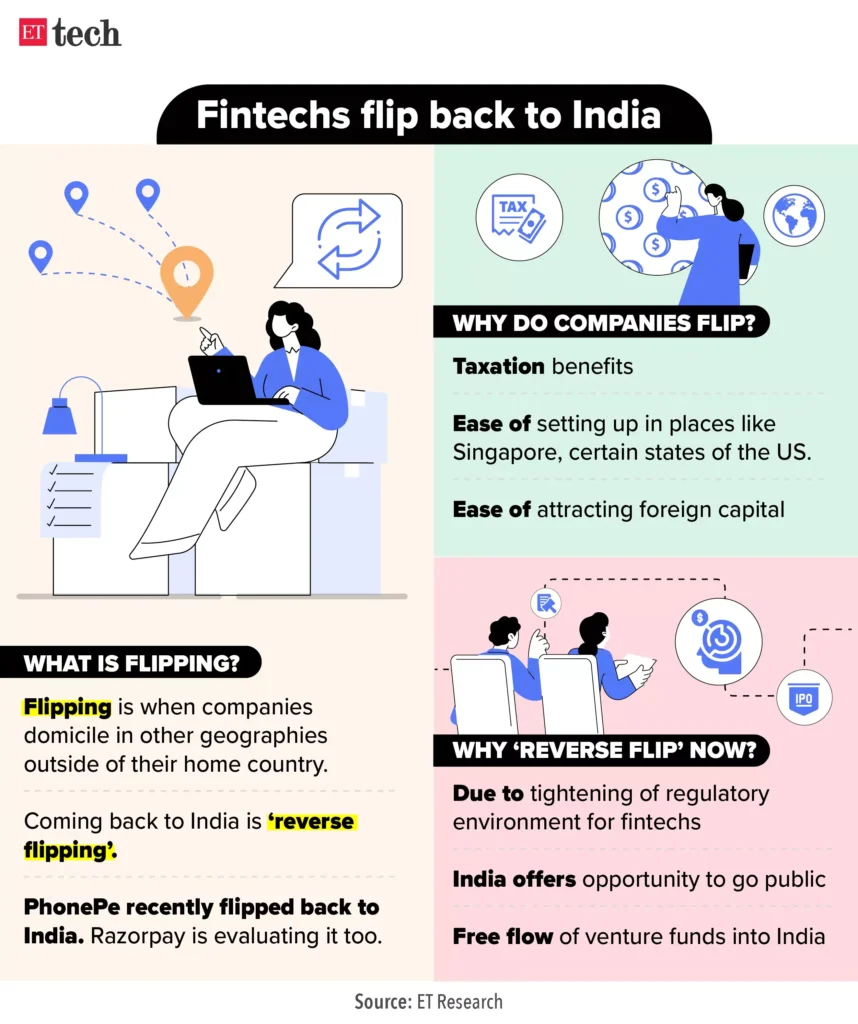

- ‘Reverse flipping’ is a term used to describe the trend where overseas startups relocate their domicile to India and subsequently list on Indian stock exchanges.

- Reverse flipping represents the opposite of the flipping trend.

- Flipping refers to the process where an Indian company becomes a 100% subsidiary of a foreign entity after relocating its headquarters overseas, including transferring intellectual property (IP) and other assets.

- In this context, startups that had previously moved their holding companies outside India are now contemplating a strategic return.

- This shift is driven by the substantial maturation of the startup ecosystem in India, making it an attractive location for these companies to operate.

- The presence of an untapped pool of domestic retail investors, seeking opportunities to invest in promising emerging companies, adds to the appeal.

- Furthermore, recent government initiatives are streamlining the process for startups to go public, enhancing the attractiveness of the reverse flipping option.

How is it done?

- Executing a reverse flip is a complex process, and startups contemplating this reversal must navigate through a maze of regulations.

- Common methods include share swaps and mergers, with potential requirements for approval from the National Company Law Tribunal (NCLT).

- Reverse flipping can pose significant tax consequences when a startup’s valuation has substantially increased since its initial flip.

- The process may be viewed as a ‘transfer of assets,’ triggering capital gains tax implications in India and potentially in foreign jurisdictions as well.

- Reverse flipping can technically result in a change in beneficial ownership, posing a risk to accumulated losses set-off against future profits.

- Start-ups must also navigate exchange control regulations when repatriating funds or assets to India, ensuring compliance with all relevant regulations.

Ref: Source

| UPSC IAS Preparation Resources | |

| Current Affairs Analysis | Topperspedia |

| GS Shots | Simply Explained |

| Daily Flash Cards | Daily Quiz |